The Ultimate Guide To Medicare Graham

The Ultimate Guide To Medicare Graham

Blog Article

The Basic Principles Of Medicare Graham

Table of ContentsFascination About Medicare GrahamThe 4-Minute Rule for Medicare GrahamMedicare Graham for BeginnersHow Medicare Graham can Save You Time, Stress, and Money.An Unbiased View of Medicare Graham

An individual who joins any one of these plans can approve power of attorney to a trusted individual or caretaker in instance they become unable to handle their events. This implies that the person with power of attorney can administer the policy in support of the strategy holder and view their medical information.

Some Of Medicare Graham

Make sure that you recognize the fringe benefits and any kind of advantages (or freedoms) that you may lose. You might want to think about: If you can change your present medical professionals If your drugs are covered under the plan's medicine list formulary (if prescription medicine coverage is offered) The monthly costs The price of insurance coverage.

What added services are used (i.e. preventative treatment, vision, dental, health club subscription) Any therapies you require that aren't covered by the plan If you intend to register in a Medicare Advantage plan, you should: Be eligible for Medicare Be signed up in both Medicare Component A and Medicare Part B (you can examine this by describing your red, white, and blue Medicare card) Live within the plan's solution area (which is based upon the region you live innot your state of house) Not have end-stage kidney disease (ESRD) There are a couple of times during the year that you may be qualified to transform your Medicare Advantage (MA) strategy: The takes place every year from October 15-December 7.

Your brand-new protection will begin the first of the month after you make the switch. If you need to transform your MA plan outside of the conventional enrollment periods defined above, you might be qualified for an Unique Registration Duration (SEP) for these qualifying events: Relocating outside your plan's insurance coverage location New Medicare or Component D strategies are available due to a step to a brand-new irreversible place Recently released from jail Your plan is not restoring its contract with the Centers for Medicare & Medicaid Provider (CMS) or will stop supplying advantages in your area at the end of the year CMS might additionally develop SEPs for certain "extraordinary problems" such as: If you make an MA enrollment request right into or out of an employer-sponsored MA strategy If you intend to disenroll from an MA plan in order to register in the Program of All-encompassing Look After the Elderly (PACE).

Unknown Facts About Medicare Graham

person and have actually ended up being "legally existing" as a "professional non-citizen" without a waiting duration in the United States To validate if you're eligible for a SEP, Medicare West Palm Beach.contact us. Medicare Lake Worth Beach.

Third, consider any medical solutions you might need, such as confirming your existing physicians and experts approve Medicare or locating protection while away from home. Check out regarding the insurance business you're thinking about.

How Medicare Graham can Save You Time, Stress, and Money.

To choose the ideal protection for you, it's essential to understand the basics concerning Medicare - Medicare South Florida. We've collected every little thing you require to understand concerning Medicare, so you can choose the plan that finest fits your demands. Allow's stroll you via the procedure of how to analyze if a Medicare supplement strategy might be right for you.

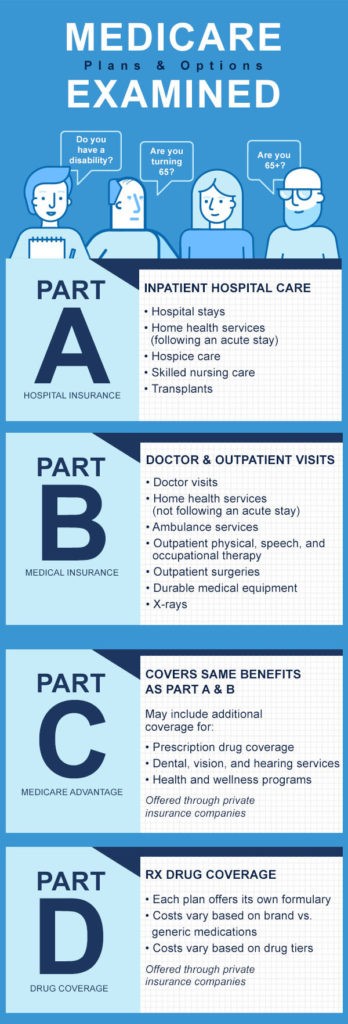

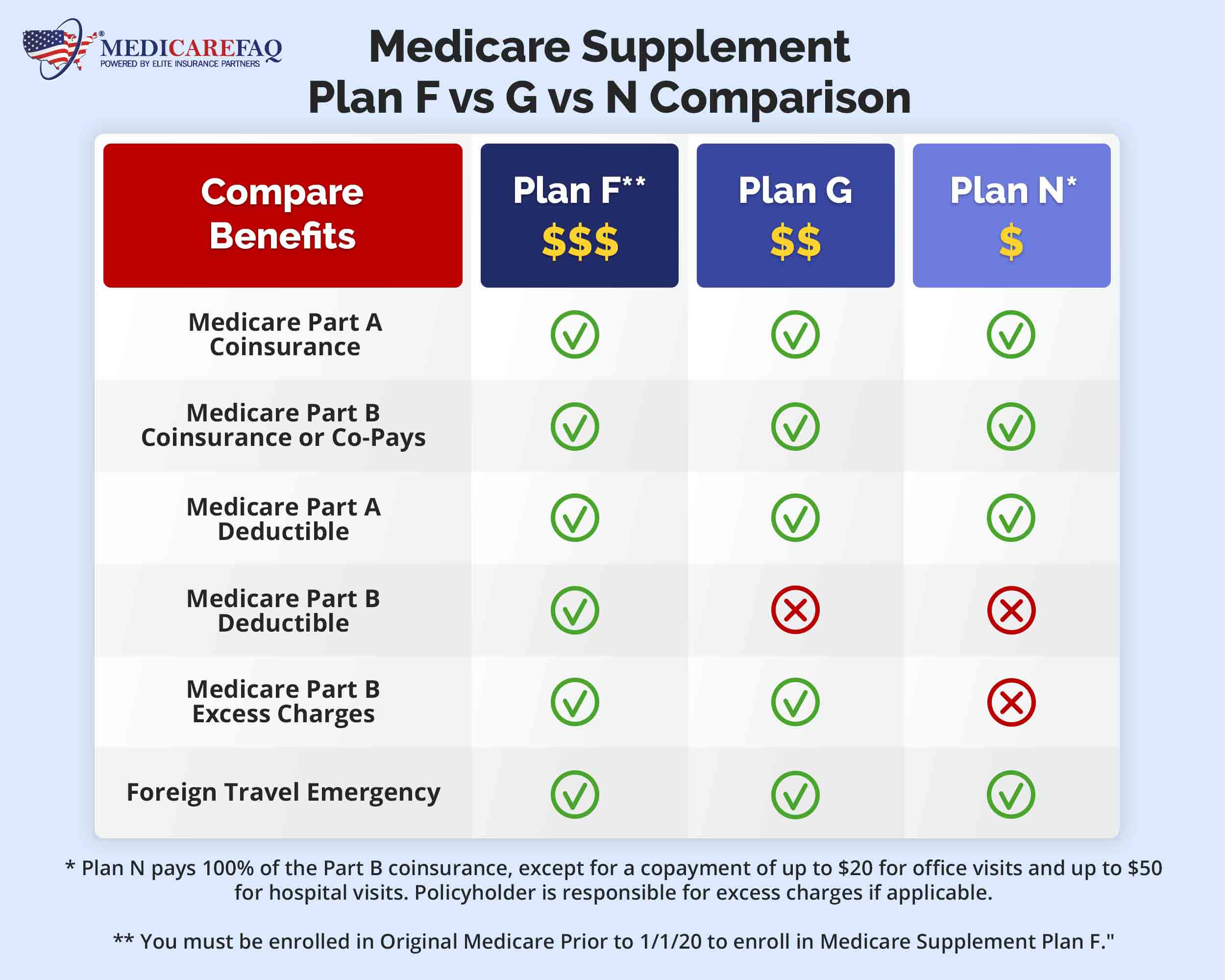

Medicare supplement strategies are simplified right into courses AN. This category makes it simpler to compare several additional Medicare plan types and pick one that ideal fits your demands. While the fundamental benefits of each kind of Medicare supplement insurance strategy are consistent by service provider, costs can differ in between insurance coverage companies.: In addition to your Medicare supplement plan, you can pick to acquire extra coverage, such as a prescription medicine strategy (Part D) and oral and vision protection, to aid fulfill your details needs.

You can locate an equilibrium between the strategy's cost and its protection. High-deductible strategies supply reduced costs, but you may have to pay even more out of pocket.

The 25-Second Trick For Medicare Graham

For instance, some plans cover foreign travel emergency situations, while others exclude them. Note the clinical solutions you most value or might call for and ensure the plan you choose addresses those demands. Private insurance firms use Medicare supplement strategies, and it's advisable to review the small print and compare the worth different insurance firms offer.

It's constantly an excellent concept to talk to representatives of the insurance coverage suppliers you're thinking about. And, when evaluating details Medicare supplement insurance coverage carriers, research their longevity, reviewed customer testimonials, and get a feeling of the brand's reputation in the insurance area. Whether you're switching over Medicare supplement plans or shopping for the very first time, there are a couple of things to take into consideration *.

Report this page